Complying with Public Sector Accounting Board Standards

The Municipal Government Act (MGA) requires that every Alberta municipality complete annual audited financial statements, a copy of which must be submitted to Municipal Affairs by May 1 of each year. The financial statements must be prepared in accordance with generally accepted accounting principles for municipal governments in Canada, as set out in the Public Sector Accounting Handbook.

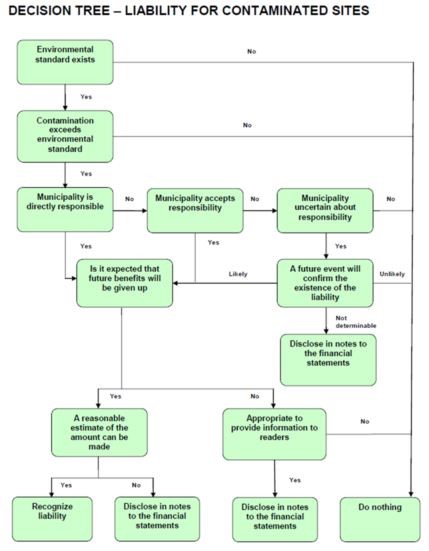

As of the 2015 fiscal year, municipalities and other public sector agencies are required to account for and report on any liabilities associated with the remediation of a contaminated site in accordance with the Public Sector Accounting Board (PSAB) standard PS 3260- Liability for Contaminated Sites.

PSAB offers a four-step approach involving identification, recognition, measurement and disclosure to help municipalities and other governments comply with the standard. A summary of these steps is based on guidance provided by BDO Canada and the Manitoba Municipal Government Municipal Finance and Advisory service,

Source: Manitoba Municipal Government – Municipal Finance and Advisory Services

Public Sector Accounting Board Standard PS 3260- Liability for Contaminated Sites

The following is a summary of the steps involved in meeting PSAB 3260, based on BDO’s A Practical Approach to Section PS 3260 and Manitoba Municipal Finance and Advisory Services’ A guide for the Adoption of PS 3260: Liability for Contaminated Sites. This document should not be regarded as formal legal or accounting advice.

Step 1: Identification

Assemble a team of knowledgeable people from different areas, such as finance, public works, engineering, and legal, to help identify a contaminated site. Your team should ask:

- Are there any sites with known contamination?

- Are there any sites where unexpected contamination has occurred (such as a chemical spill)?

- Are there any sites that have a history of contamination (such as a site previously used for industrial purposes)?

- Are there any sites not in use and why are these sites not in use? Are there any sites not included on the list where contamination may exist?

Step 2: Recognition

The criteria for recognition of a contaminated site is outlined in five phases. These include:

1) An environmental standard exists in a statute, regulation, by-law, order, permit, contract or agreement (See the following section on provincial standards and regulation).

2) Contamination exceeds the existing environmental standard. Some factors to consider when determining if the contamination exceeds the standard include:

- The nature of past activities at the site or adjacent properties

- Site location, hydrology and geology

- Results from testing and field investigations

- Similarities to and experience at other known contaminated sites

- Significance of the site

- Cost versus benefit of conducting a detailed site assessment

3) The municipality is directly responsible or accepts responsibility for the contamination.

- Responsibility- A municipality may be directly responsible for remediation due to its own past activities that have caused contamination (such as a municipally operated transportation work yard). A municipality may also be directly responsible when activities occurred on government-owned land or land the government has since acquired, and a responsible party cannot be identified or lacks the means for remediation

- Accepted Responsibility- If it so chooses, a municipality may voluntarily accept responsibility for the remediation of a contaminated site.

- Uncertain Responsibility- A situation may occur where an environmental standard exists, contamination exceeds the standard, the municipality is not responsible and does not accept responsibility, but there is uncertainty as to whether the municipality may be responsible. The municipality may in fact have a contingent liability. A municipality’s liability may be recognized if it can be reasonably estimated.

4) It is expected that future economic benefits will be given up (such as the payment of cash or provision of services)

5) In determining whether the recognition criteria for each site has been identified, the following should be considered:

- Have we identified all the existing environmental standards the municipality is required to comply with?

- Has contamination actually exceeded any of these environmental standards?

- Is the municipality directly responsible for the site?

- If not directly responsible, has the government accepted responsibility?

- Is there uncertainty as to whether the government is responsible for remediating a contaminated site?

- Are there any sites where contamination exceeding an environmental standard exists, but for which the government does not expect to give up future economic benefits and it is unlikely the municipality would be forced to remediate these sites?

- Are there any contaminated sites where the municipality is unable to come up with a reasonable estimate of the amount for remediation?

Step 3: Measurement

For each site that meets the recognition criteria, determine an appropriate estimate of the liability. This should include costs required to bring a site up to the current minimum standard for its use prior to contamination. These costs include activities such as:

- Post-remediation operation, maintenance and monitoring costs that are an integral part of the remediation strategy for a contaminated site, which would include costs such as payroll and benefits, equipment and facilities, materials, legal and other professional costs;

- Costs of tangible capital assets acquired as part of remediation activities to the extent those assets have no alternative use; and

- Costs related to natural resource damage (such as re-vegetation outlays), but only if they are incurred as part of an environmental standard.

Furthermore, the measurement technique used by the municipality to determine liability should result in the best estimate of the amount required to remediate the contaminated site. The amount would be based on the best estimate of the expenditures required to complete the remediation. Professional judgment, third party quotes and reports of third party experts should be considered. A present value technique is often the best manner technique to use when the cash flows required to settle or otherwise extinguish the liability are expected to occur over extended periods.

The liability for remediation is reduced by any expected net recoveries if the recognition criteria is satisfied.

The goal is to ensure that the estimate of the liability for remediation of each contaminated site is reasonable. The following should be considered:

- Was the information used in estimating the liability available at the financial statement date?

- Are the costs included in the estimated liability directly attributable to the remediation activities?

- Have we taken into consideration available site assessment information and experience gained at other similar sites?

- Was an appropriate measurement technique used?

- Have we evaluated the consistency of information across similar sites?

- Has an expert been used? If not, is an expert needed?

- Has the liability for remediation been reduced by any expected net recoveries that meet the recognition criteria?

Step 4: Disclosure

At this point in the process, the liability for remediation of all contaminated sites will be recognized and presented in the financial statements. The following disclosures must be included:

- The nature and source of the liability;

- The basis for the estimate of the liability;

- When a net present value technique is used, the estimated total undiscounted expenditures and discount rate;

- The reasons for not recognizing a liability; and

- The estimated recoveries.