Support for Alberta Film Industry & Economic Diversification

IT IS THEREFORE RESOLVED THAT AUMA advocate for the Government of Alberta to further enhance its Film and Television Tax Credit (FTTC) to be more competitive with the jurisdictions of Ontario, British Columbia, and Manitoba in attracting screen industry production to the Province and expand the growing sector into an economic engine for the province.

FURTHER BE IT RESOLVED THAT the Government of Alberta promote and develop the screen industry in rural Alberta as a tool to leverage for tourism by:

- The addition of a “rural location” incentive towards projects that shoot in rural locations

- Promotion of towns which feature projects

- Coordinated marketing and infrastructure projects towards screen-based tourism initiatives

WHEREAS with the advent of streaming services increasing the distribution of screen content worldwide, the screen industry is a growing global economic driver;

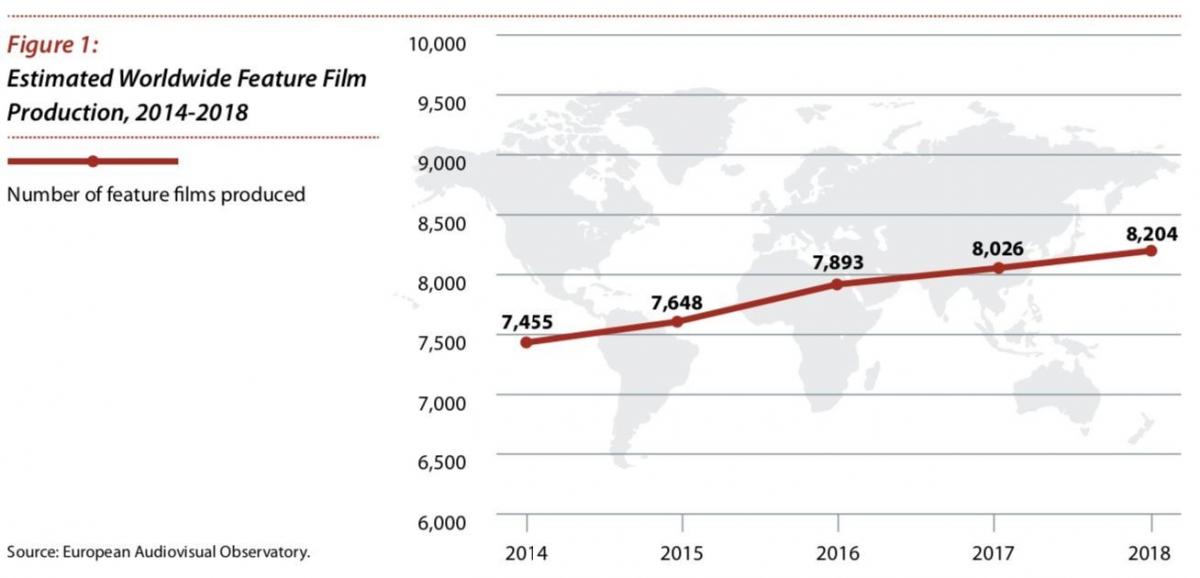

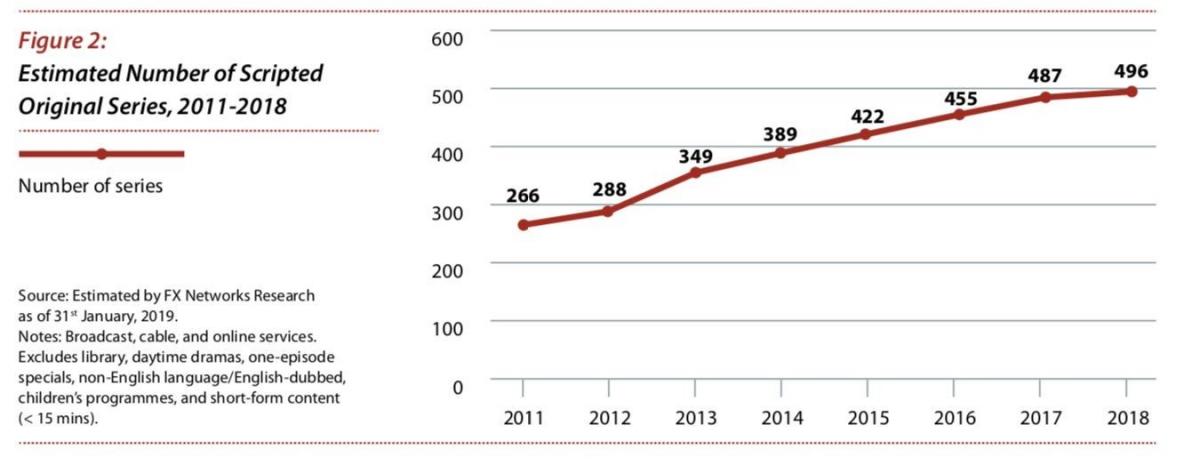

WHEREAS the number of “scripted original series” television shows produced per year worldwide increased from 266 to 496 in the period of 2011-2018 and the number of feature films produced per year increased from 7,455 to 8,204 in the period of 2014-2018 each representing tens of millions in investment where produced;

WHEREAS the screen industry in Alberta is the 4th largest jurisdiction in Canada being a driver of indirect and induced GDP spending of $236 million in 2018;

WHEREAS the screen industry in Alberta employs an estimated 3,357 highly skilled professionals in jobs that are transferable from other sectors;

WHEREAS the screen industry in Alberta has failed to see the explosive growth of its competitor province jurisdictions of British Columbia and Ontario because of a capped tax credit (previously a grant system). British Columbia saw $2.6 billion in motion picture expenditures in the province in 2017/2018 and 60,870 jobs. Ontario saw 2.36 billion in motion picture expenditures in 2017/2018 and roughly 32,000 jobs; and

WHEREAS the screen industry is a proven effective driver of tourism and promotion for the areas that embrace it, attracting fans of the shows to the location productions were made.

The importance of the screen industry to Canada is obvious, as is the impact to the local, provincial, and federal economies that are well researched and promoted. In Alberta, despite having some of the most naturally beautiful and diverse landscapes available to productions, we have previously lacked a competitive incentive and provincial strategy to take advantage of this opportunity.

- The recognized return on investment for the screen industry is at least $3.50 dollars per $1 dollar spent as per Minister of Culture Leela Aheer’s statement in Alberta Legislature June 20, 2019.

- According to an Ontario film study for each dollar of their incentive spent $1.20 is returned to provincial coffers.

- According to a study done by the Association of Film Commissioners International, incentives next to infrastructure and labour force are the key deciding factors in where productions choose to shoot, and which jurisdictions are chosen as “hubs”.

The estimated production spend of major screen industry companies is growing exponentially each year.

Given these numbers, the need for Alberta governments to support a strong and vibrant screen industry sector is clear.

Investment in the film and television industry extends beyond the set:

- Heavy equipment rentals, location owners, catering companies, taxi services, hotels, airlines, commercial real estate, building supply stores, gas stations, restaurants and pubs, coffee shops.

- Clothing stores, vehicle rental, home décor.

Ghostbusters

- 14,627 room nights: $2,205,647 hotels in Calgary, Fort Macleod, Drumheller

- 225,000 L of gas, rental, and crew vehicles

- $395,560 on catering, local grocers, restaurants, distributors

- $800,000 rental vehicles

- $500,000 lumber for construction of sets

Jumanji

- 2800 room nights $445,400 Kananaskis

Togo

- 2900 room nights $539,400 Kananaskis and Nordegg hotels

- $2,100,000 spent in Cochrane

Let Him Go

|

|

|

|

|

|

Tin Star – season 2

|

|

|

|

|

|

Heartland – seasons 1 to 10

- $278.5 Million production expenditure

- $469.1 Million total economic benefit

The film industry is a great leveraging tool to attract tourists. Every show has some tourism potential - some already have fan bases (Ghostbusters), some build them up over time (Heartland, Wynonna Earp) and some people are fans of a certain genre or actor. By working together as an industry with Municipalities, Direct Marketing Organizations, and agencies like Travel Alberta we can reach new markets and create new experiences for people to take part in throughout the province. This allows places in rural Alberta an especially unique opportunity (examples seen in High River with Heartland, Didsbury with Wynonna Earp).

On January 28, 2020 the Film and Television Tax Credit Act was proclaimed by the Government of Alberta - this tax credit put in place a per project cap of $10 million, allocated only 22 million for the 2020 year, 31 million for 2021, and 45 for 2022 and had no rural incentive. These limits service only a few projects and will cause a loss of crew to other jurisdictions and plateau of the industry if not addressed.

Therefore, we recommend the key elements for a competitive Film and Television Tax Credit include:

- An open yearly cap depending on the number of applicants and crew capacity

- No Per Project Cap (Currently GoA policy $10M/Project)

- A Rural Location Bump Up of up to five per cent for productions shooting outside of Calgary & Edmonton (in line with other jurisdictions)

In their response to the resolution, the Alberta government reiterated their support for Alberta's film industry through the Alberta Film and Television Tax Credit. They also pointed to the work of the Alberta Film Commission in support the Alberta film industry. The response did not address the request for a rural location incentive or coordinated marketing and infrastructure projects towards screen-based tourism initiatives.

Intent partially met

ABmunis was pleased to see that funding for the Alberta Film and Television Tax Credit was maintained in the provincial budget. ABmunis will continue to advocate to the provincial government to expand the criteria of the Alberta Film and Television Tax Credit. ABmumis’ Economic Resiliency and Recovery Task Force also included the importance of promoting Alberta's communities as places to do business as one of their action items.